Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

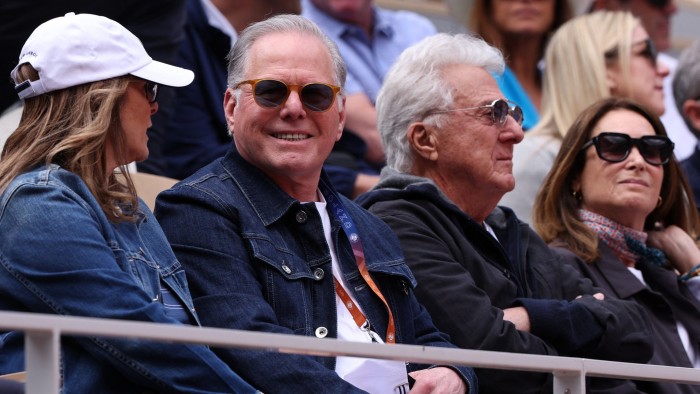

Viewers of the NBA basketball playoffs and French Open tennis have sighted many a celebrity in the VIP box, from moviemaker Spike Lee to cinematic hotshot Timothée Chalamet. And sitting among them was Warner Bros Discovery boss David Zaslav, more suit than superstar, perhaps, but a financial newsmaker in his own right.

On Monday he announced the company he runs would split in two, a break-up discussed almost a year ago: streaming platforms and Hollywood studios, including HBO and Warner Bros, will live in one company — which Zaslav will continue to run — while pay-TV networks such as CNN and Discovery will reside in the other.

Zaslav is right to get creative over WBD. Since he birthed the company by merging Time Warner and Discovery Communications in 2022, parlaying his CEO role at Discovery into a leadership of the enlarged group, the shares are down 60 per cent. Shareholders are restless: they recently voted down Zaslav’s lavish $52mn pay package, which had grown despite the company reporting an $11.5bn loss in 2024.

But while a cleaner structure ought to please Wall Street, both halves have their challenges. Streaming is growing rapidly, but is costly to build out, and faces tough rivalry from Walt Disney and Netflix, whose $540bn enterprise value is nine times that of WBD. Pay TV, meanwhile, generated $8bn of the group’s $9bn in ebitda last year, but investors don’t much value that business and subscribers are melting away.

Then there’s $36bn of debt which, like overheads and expenses, will have to be shared across the two new companies. Zaslav plans to buy back some of the company’s bonds, many of which are trading at about 70 cents on the dollar because they were issued by Time Warner and Discovery amid lower interest rates. WBD presumably hopes it can buy them back for not much more than that. Hedge funds holding the debt may disagree.

Across the media world, big groups are girding for battle. Comcast is spinning off its TV networks into a new company called Versant. Paramount Global is selling itself to Skydance Media. Fox and AT&T smartly sold their old-school media businesses at top valuations. Disney and Comcast have the benefit of extra ballast from their theme park businesses, among other activities — and Netflix has won the streaming war while lacking the historical baggage of its rivals.

Even a cleaned-up WBD will therefore struggle to reach anything like supremacy. Merging Discovery with Time Warner three years ago was supposed to create a company that stood among the A-list when it came to Hollywood and sports entertainment. Zaslav’s appearances in the best seats at the best events, and his excessive pay, make it seem like that plan succeeded. Shareholders, sitting in the cheap seats, will have a different perspective.